IR35 Survival: Stay Compliant and Protected

12 Aug, 20244 Minutes

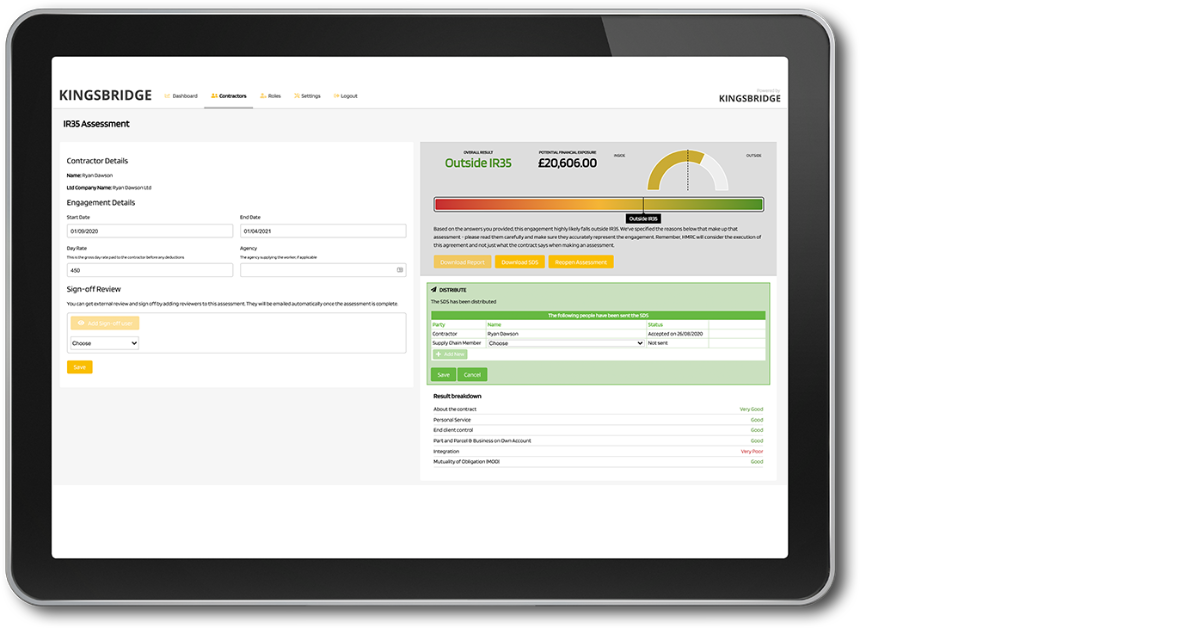

April 2021 saw a major change to UK tax law for hiring contractors, and with so much confusion, many organisations are uncertain on how best to navigate IR35 compliance. To help our clients, Spectrum IT has partnered with Kingsbridge Group to provide an award-winning solution to help manage IR35 processes. This includes a dedicated portal to complete your determination assessments, and these can be backed by IR35 insurance to help minimise risk.

“It's so simple to use the tool! The additional notes were helpful when considering each question and the outcome was quick to be calculated at the end. It makes the process far simpler, especially as there are so many grey areas”

Access to Kingsbridge’s IR35 experts for legal advice, business reviews etc. will provide clients with additional peace of mind. Kingsbridge currently works with over 50,000 contractors and since 2021 has engaged with over 4,200 end-hirers.

All the below can be included as part of Spectrum IT’s services to its clients:

Using this IR35 Solution & maintaining your flexible workforce will:

- Help you maintain a compliant workforce

- Save you time and money by outsourcing the assessment process

- Allow you to confidently engage contractors knowing the IR35 tax risk is minimised

- Manage potential tax liability and defence costs

- £100,000 of cover per contractor for professional fees to defend an IR35 status enquiry

- £100,000 of cover per contractor for Tax & National Insurance liabilities, interest and penalties per year, in the event your contractor(s) are deemed inside IR35 by HMRC

- Ensure you have access to the best talent

- Contractors insured monthly for full flexibility on engagements

- Prevent disruptions to your projects

Please note, Spectrum IT does not and can not provide financial or legal advice. We recommend consulting a qualified expert for guidance on these matters.